IC Design MediaTek announced its revenue for September 2025. Due to the sales effect of the recently launched Dimensity 9500 series flagship SoC driving business momentum, the consolidated revenue in September reached NT$54.33 billion, an increase o...

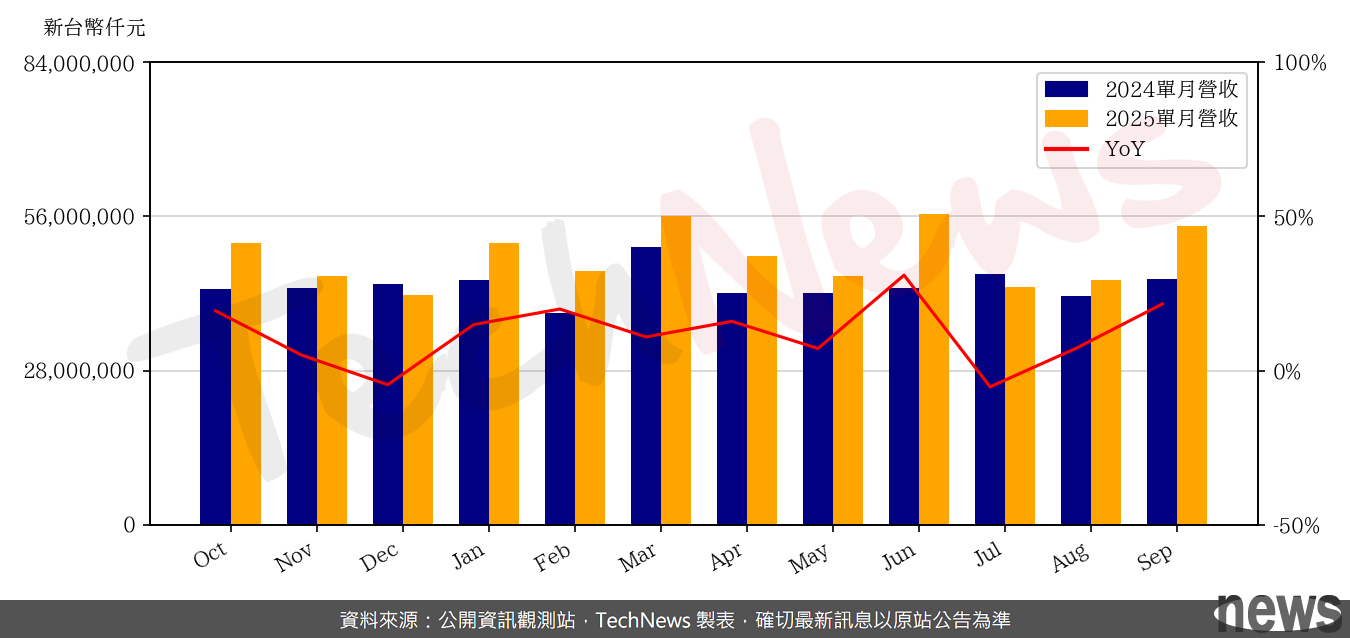

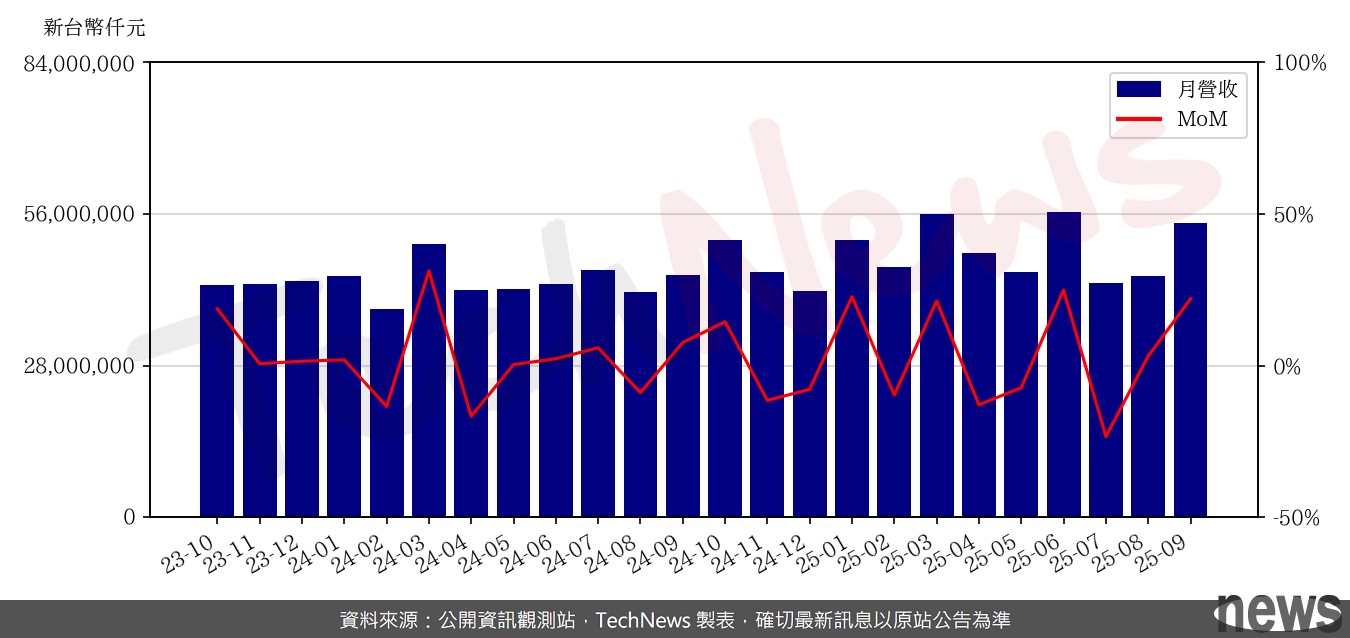

IC Design MediaTek announced its revenue for September 2025. Due to the sales effect of the recently launched Dimensity 9500 series flagship SoC driving business momentum, the consolidated revenue in September reached NT$54.33 billion, an increase of 21.96% from August and an increase of 21.61% from the same period in 2024. Cumulatively, consolidated revenue in the third quarter reached 142.096 billion yuan. Although it decreased by 5.5% from the second quarter, it still increased by 7.8% from the same period in 2024, which was better than the company's previous financial forecast.

According to MediaTek’s previous financial forecast for the third quarter, based on the U.S. dollar to Taiwan dollar exchange rate of 1:29, consolidated revenue in the third quarter will be between NT$130.1 billion and NT$140 billion, a decrease of 7% to 13% compared with the second quarter, and a decrease of 1% from 2024 to a growth of 6%. However, actual performance was better than expected. Cumulatively, combined revenue in the first three quarters of 2025 reached 445.78 billion yuan, an increase of 13.6% compared to the same period in 2024.

MediaTek recently launched its new flagship mobile phone chip Dimensity 9500, which is produced using TSMC’s 3nm process. It is expected that the first batch of smartphones equipped with the Dimensity 9500 chip will be launched in the fourth quarter, driving the growth of MediaTek’s flagship mobile phone chip performance. However, MediaTek previously stated that the smart device platform had to be shipped ahead of schedule in the first half of the year due to some demand, causing smart device platform revenue to decline in the third quarter compared with the second quarter. In addition, as demand for consumer electronics declined, MediaTek's power management chip revenue in the third quarter also fell compared with the second quarter.

Recently, MediaTek's stock price has been under pressure because foreign investors are bearish on MediaTek's operational development for four major reasons, including TSMC's price increase, mobile phone chips facing more intense competition, Arm's possibility of raising royalties in 2026, and Google's ASIC project may be delayed again. These factors are bearish on MediaTek's future development. Therefore, it will be interesting to see what kind of positive news MediaTek’s upcoming third quarter 2025 conference will release in order to clear up the haze of the stock price retracement.