2025 is the first year of active ETFs. Fuhua Investment Trust today launched the first active ETF "Active Fuhua Future 50 (00991A)", which focuses on the long-term fundamentals of individual stocks and actively selects stocks from the top...

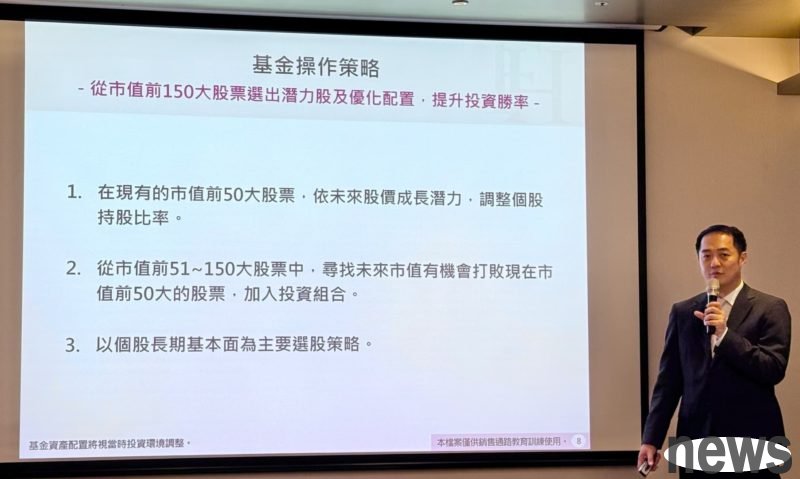

2025 is the first year of active ETFs. Fuhua Investment Trust today launched the first active ETF "Active Fuhua Future 50 (00991A)", which focuses on the long-term fundamentals of individual stocks and actively selects stocks from the top 150 market capitalization stocks with a better winning rate to explore the future of Taiwan stocks Taiwan 50. It is expected to start raising funds on December 3.

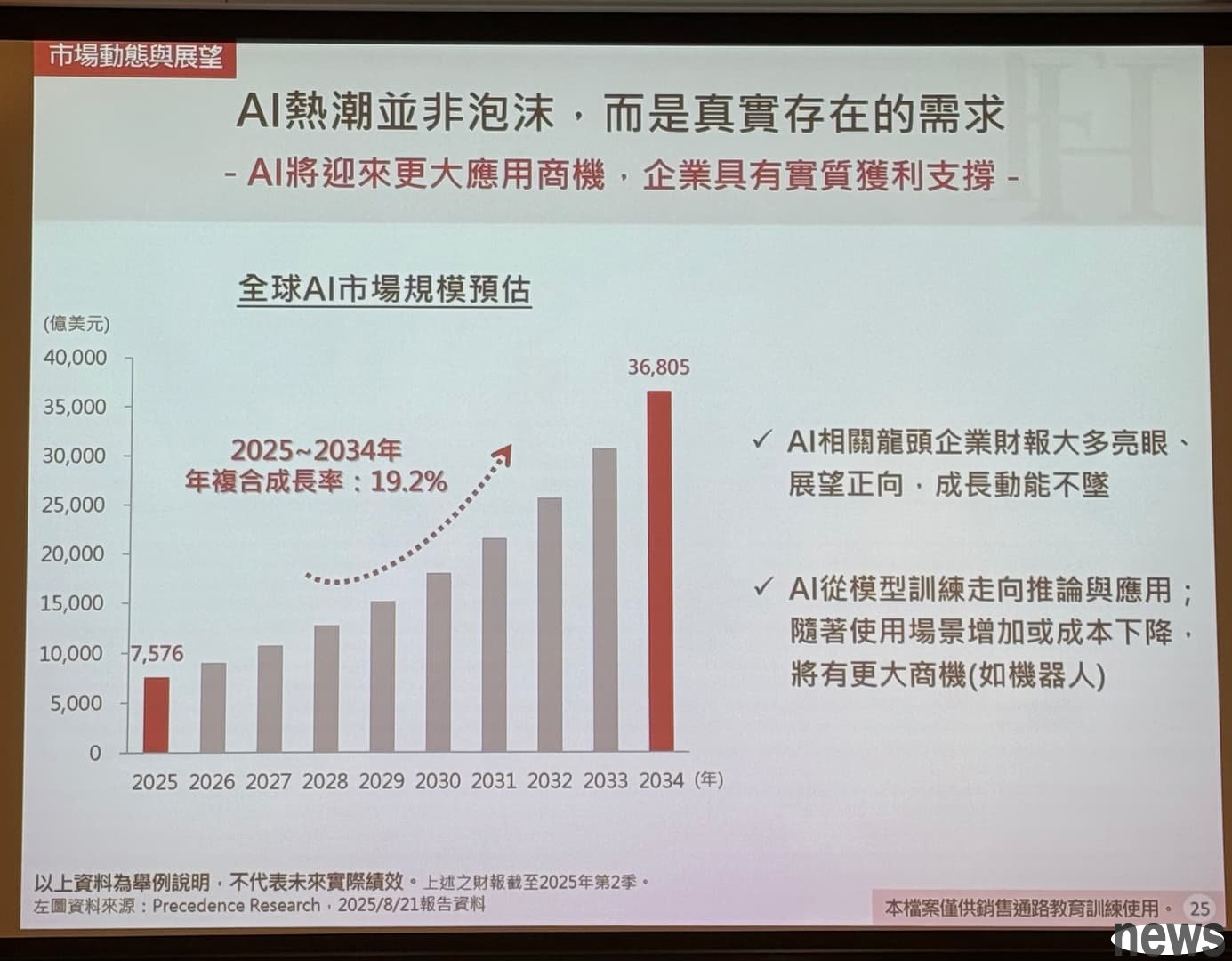

Fuhua Investment Trust stated that Taiwanese stocks have caught on to the high-growth train of AI in recent years, and the market has repeatedly hit new highs. Looking forward to the market outlook, AI is still a high-speed growth market, and Taiwan's supply chain is full of business opportunities. Therefore, it is recommended to select stocks from the top 150 market capitalization, through active stock selection and eliminating the weak and retaining the strong, taking into account the return potential, and grasping the investment opportunities of the new 50 overlords of Taiwanese stocks in the future.

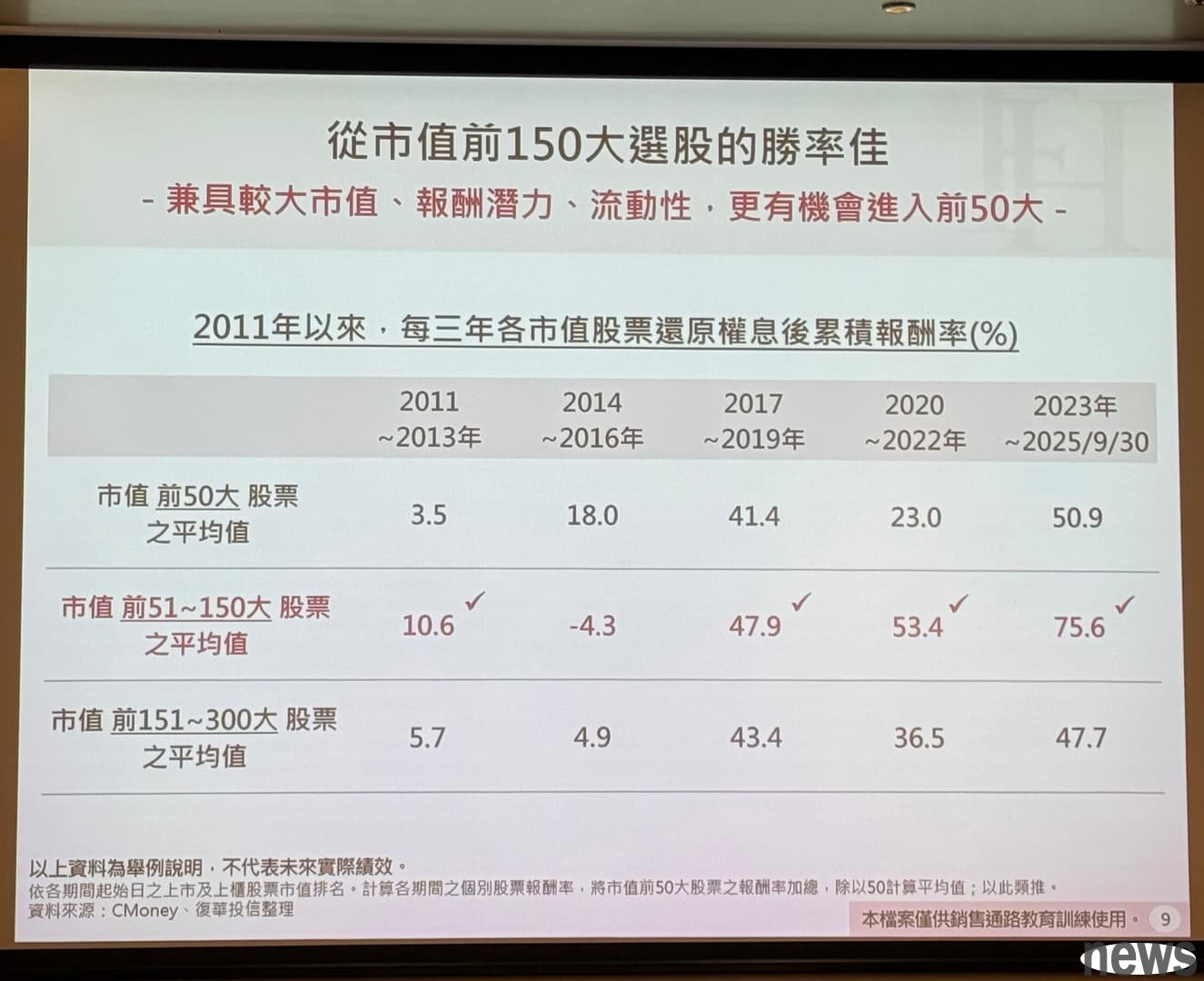

According to CMoney statistics, every three years since 2011, the cumulative return rate of each market capitalization stock after restoration of dividends has been calculated. The average return of the top 150 stocks by market capitalization is much higher than the top 300 and top 50 stocks by market capitalization. If we further select stocks from the top 51 to 150 stocks, the average return rate is mostly better than the other two. Among them, the cumulative average return rate from 2023 to now is 75.6%, which is better than the top 50 and top 50 stocks. 151 to 300 large.

Lu Hongyu, head of the domestic equity department of Fuhua Investment Trust and active manager of Fuhua Future 50, said that the main reason is the creation of new stocks that benefit from the AI era. Taiwan’s local hidden champions have become global leaders through the AI supply chain, further driving corporate revenue and stock price performance, and causing changes in the top 50 companies in the Taiwan stock market, further providing Taiwan stock layout with large market capitalization, return potential, and liquidity. Stock investment opportunities.

Lu Hongyu believes that although Taiwan stocks have concerns about a high base period in the short term, the United States has entered a cycle of interest rate cuts and overall corporate profits have been revised upward, providing entry points for bargain hunting. It is recommended to operate on the long side, follow the largest growth trend, and focus on the AI supply chain with better growth and industry visibility, including advanced packaging and testing, ODM, heat dissipation, PCB, power supply, mechanism, high-speed transmission, and the memory industry that welcomes the turnaround.

Further reading: The "Strategic Taiwan Investment Forum" is here! Blackstone: TSMC will help Taiwan’s stock market value exceed 100 trillion yuan Taiwan stock active ETF is rushing to launch nine stocks this year, check it out at once! First Gold Taiwan Stock Trend Select Active ETF is ready to be raised Trump’s “America First” policy pushes up the S&P and Nasdaq! Fubon’s three U.S. umbrella funds open on 11/24